A few weeks ago, I walked out of a coffee shop in Amsterdam, enjoying my latte, when it hit me—I hadn’t pulled out my wallet, scanned a QR code, or even touched my phone. The payment had happened automatically, thanks to an app synced with the store’s system.

It felt effortless, almost magical. But this wasn’t magic—it was invisible payments in action.

Invisible payments are changing how we interact with money, making transactions so seamless that the act of paying disappears entirely.

What Are Invisible Payments?

Invisible payments are transactions that happen automatically without requiring the customer to take explicit action. They rely on technology like AI, IoT, and mobile apps to make the payment process:

- Frictionless: No swiping, scanning, or tapping.

- Automated: Payments happen in the background.

- Integrated: Connected to loyalty programs, purchase history, and customer preferences.

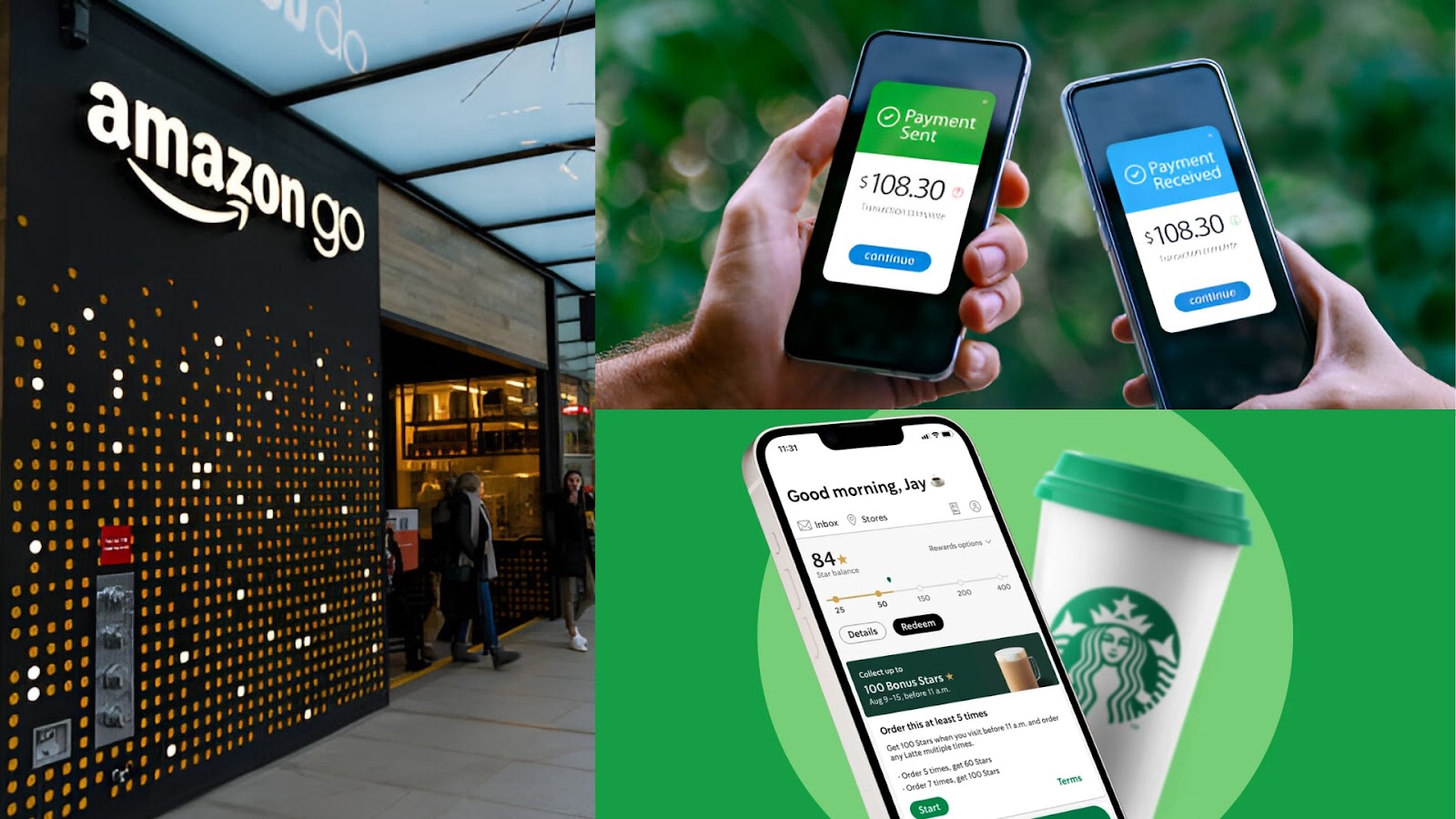

Think of Amazon Go stores, where you grab what you need and walk out—the system charges your account automatically. Or ride-sharing apps like Uber, where the payment is settled as soon as you step out of the car.

By 2030, invisible payments are expected to account for over $78 billion in global transactions annually, reflecting a fundamental shift in customer expectations.

Why Invisible Payments Matter

For customers, invisible payments mean:

- Convenience: No lines, no waiting, no fumbling for cash or cards.

- Speed: Faster checkouts lead to better experiences.

- Simplicity: Everything feels integrated and effortless.

For businesses, the benefits are just as significant:

- Higher Conversions: Customers are less likely to abandon purchases when the process feels effortless.

- Loyalty Integration: Invisible payments make it easier to tie transactions to loyalty programs.

- Data-Driven Insights: Every transaction adds to a rich pool of data, helping brands refine their offerings.

Real-World Examples of Invisible Payments

- Amazon Go: These cashier-less stores use sensors, cameras, and AI to track what you take and charge your account when you leave.

- Uber: Payments happen automatically after your ride, creating a frictionless experience.

- Starbucks App: By integrating payments with rewards, Starbucks ensures customers never have to think about pulling out their wallet.

Each of these examples showcases how invisible payments are creating better, faster, and more personalized experiences.

Challenges in the Invisible Payment Ecosystem

While the concept is groundbreaking, it’s not without its hurdles:

- Privacy Concerns: Customers worry about how their data is used and stored.

- Security Risks: Automating payments increases the stakes for fraud prevention.

- Adoption Barriers: Smaller businesses may find the technology too complex or costly to implement.

The key to addressing these challenges is trust. Customers need to feel that their data is safe, their transactions are secure, and their privacy is respected.

So, Where Does This Leave Us?

Invisible payments aren’t just a trend—they’re a transformation in how we think about commerce.

For businesses, the challenge isn’t just adopting this technology—it’s about using it to create meaningful, trust-driven customer experiences.

So here’s the real question:

“Are we building payment systems that customers notice—or ones they never have to think about?”

Because in a world where every second counts, the best payment is the one that feels invisible.

Regards,

Rupesh

Leave a Reply